Introduction

Taxes are a fact of life, but let’s face it - figuring out tax systems can be downright confusing. In a recent podcast, Ferhat Sanci, a tax advisor with more than 10 years of experience working in important tax departments shared valuable insights into global tax systems, common misconceptions, and strategies for optimizing personal and business finances.

This blog explores these key topics to help you make informed decisions about your taxes, whether you’re a business owner, expat, or middle-income earner.

Expert Tax Advisor - Paying Less Taxes & Keeping More Money: Ferhat Sanci | E10

Clarifying Tax Concepts and Opportunities

One of the foundational concepts in taxation is the distinction between tax evasion and tax avoidance, a line that defines legality and ethics in managing taxes.

Tax Evasion refers to illegal practices such as underreporting income or falsifying financial records to avoid paying taxes. These actions not only undermine the integrity of financial systems but also carry severe legal repercussions for individuals and businesses. In stark contrast, Tax Avoidance involves legally minimizing tax liability through strategic planning. This could include leveraging deductions, credits, or treaties to align with existing laws.

While tax avoidance is a legitimate and strategic approach, it is crucial to navigate it carefully and comply with regulations. Misguided attempts, such as exploiting loopholes or relocating to low-tax jurisdictions without meeting residency or operational requirements, can result in significant penalties. Understanding the rules is essential to avoid crossing the boundary into evasion.

For skilled workers abroad, such as those relocating to the Netherlands, understanding legal tax benefits like the 30% ruling is a vital part of effective tax planning. This unique incentive allows eligible expats to receive up to 30% of their gross salary tax-free, significantly reducing their tax burdens. However, the application process for the 30% ruling can be cumbersome, often delayed by outdated systems and inefficiencies. Streamlining this process through automation could not only improve the experience for expats but also enhance efficiency for tax authorities.

By distinguishing between tax evasion and avoidance and leveraging legitimate opportunities like the 30% ruling, individuals can manage their taxes strategically while remaining compliant with the law.

Why Are Tax Systems So Inefficient?

Many tax systems, particularly in Europe, struggle with persistent inefficiencies due to outdated technology, insufficient resources, and a lack of streamlined processes. These inefficiencies can cause bottlenecks, leading to delays, increased costs, and frustration for both taxpayers and authorities. A notable example is the Dutch Box 3 taxation system, which governs taxes on savings and investments. This system has been criticized for its inability to adapt to modern requirements, with efforts to reform it facing years of delays.

The root cause of such inefficiencies often lies in legacy systems - older technologies that struggle to accommodate new regulations and the complexities of a modern economy. These systems are not only slower but also more prone to errors, making the process of implementing changes costly and time-consuming.

Ferhat highlighted that while many countries grapple with these challenges, others have modernized their tax infrastructure. For instance, Poland has taken significant strides to digitize its tax systems, incorporating advanced technology to enhance efficiency and accuracy. This modernization has simplified compliance, reduced delays, and improved overall user experience.

Learning from such examples could provide a roadmap for other European nations to streamline their tax systems. By investing in technology and prioritizing modernization, tax authorities could not only improve operational efficiency but also build greater trust with taxpayers by ensuring transparent and timely processes.

The Dubai Myth and Low-Tax Realities

Countries like Dubai, Portugal, Cyprus, and Spain often lure individuals and businesses with promises of minimal taxes. However, relocating to such jurisdictions is far more complex than it appears. Residency rules, treaties, and business operations play a crucial role in determining where taxes are owed.

For instance, even if a business is registered in Dubai, its income may still be taxable in the Netherlands if the owner resides there. Similarly, tax treaties may only apply under specific conditions, such as holding an Emirati ID. Short-term gains from low-tax jurisdictions can lead to long-term legal and financial challenges, making professional guidance essential.

Wealth Planning and Foundations

For high-net-worth individuals, wealth planning is a crucial strategy for preserving and efficiently transferring assets to future generations. One effective tool in this domain is the establishment of foundations. Foundations offer a structured and legally recognized way to manage wealth, reduce inheritance taxes, and ensure a smoother transition of assets to heirs.

In the Netherlands, inheritance tax - known locally as "Adolf blasting" - can significantly erode the wealth passed on to the next generation. Without proper planning, heirs may face substantial tax burdens, reducing the overall value of their inheritance. Setting up a foundation can help mitigate these taxes by allowing individuals to manage their wealth in a more tax-efficient manner. Additionally, strategies such as transferring wealth incrementally during one’s lifetime can further reduce taxable amounts, providing greater financial stability for heirs.

Foundations are particularly advantageous for families or individuals with substantial assets. They not only serve as a means of preserving wealth but also help in avoiding potential disputes among family members. By establishing clear governance structures and objectives, foundations ensure that wealth is managed in alignment with the founder’s long-term vision, fostering harmony and clarity within the family.

Moreover, foundations often provide flexibility for philanthropic endeavors, allowing high-net-worth individuals to integrate charitable activities into their wealth management plans. This approach can leave a lasting legacy while optimizing tax benefits. With the right planning and professional advice, foundations can be a way to secure financial security and maintain family unity across generations.

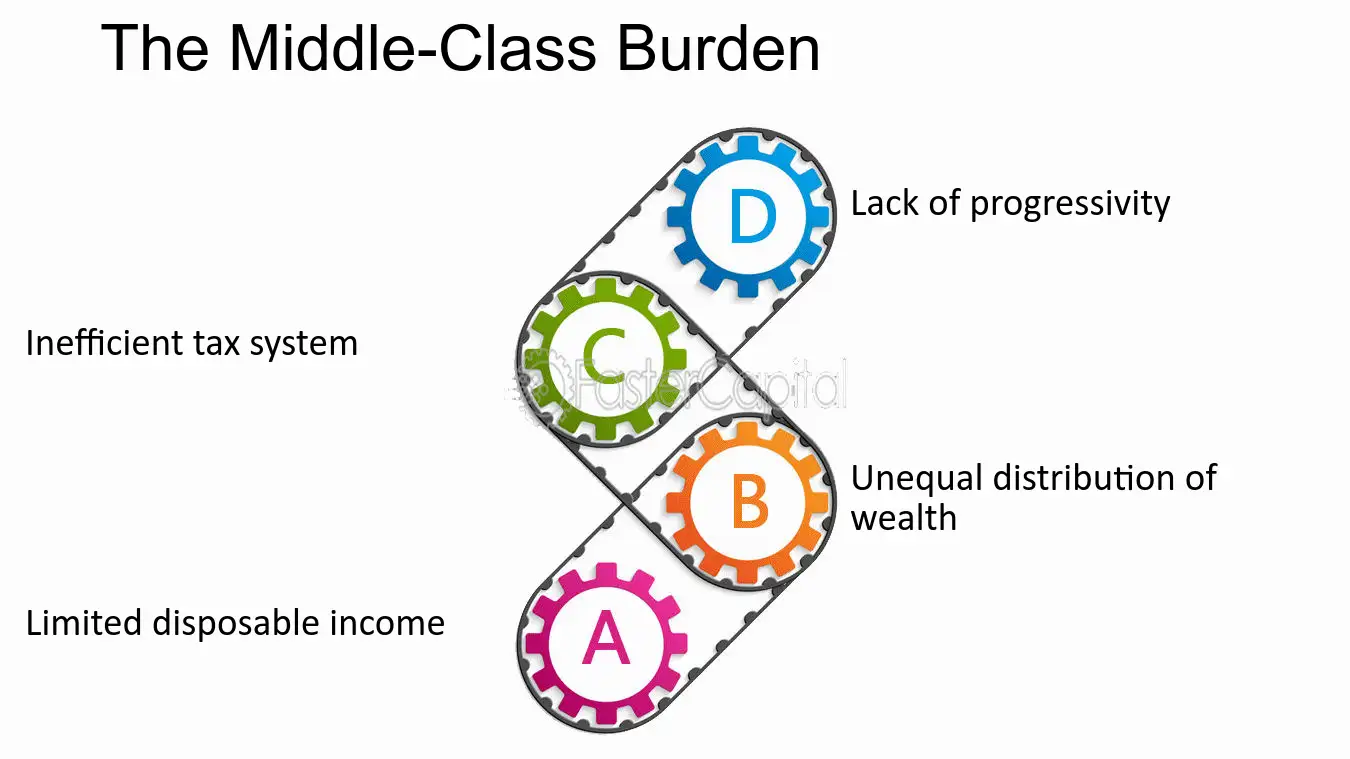

The Hidden Burden on the Middle-Class

One of the more surprising insights is that middle-class earners often face the heaviest tax burden. While low-income individuals benefit from subsidies and tax breaks, and high-income earners can afford sophisticated tax strategies, the middle class often pays disproportionately high taxes without access to similar benefits.

This highlights the importance of middle-class earners exploring all available tax deductions, credits, and exemptions to reduce their liability. Investing in financial planning, even on a modest scale, can make a significant difference in minimizing tax burdens and improving long-term financial health. Understanding the nuances of tax systems and seeking professional guidance can empower middle-class earners to navigate these challenges more effectively.

Practical Steps for Tax Optimization

Deciding whether to purchase or lease a car for business purposes involves a range of tax considerations that can significantly impact overall financial outcomes. One important factor is the "benefit-in-kind" tax, which applies to a percentage of a car’s new value if it is used for personal purposes exceeding 500 km annually. Interestingly, luxury vehicles like Porsches may offer better financial value than mid-range cars, as their slower depreciation can make them a smarter investment. Similarly, leasing may be more advantageous than purchasing if the saved capital can be reinvested to achieve higher returns elsewhere. These decisions should always align with the specific financial situation and long-term goals of the individual or business.

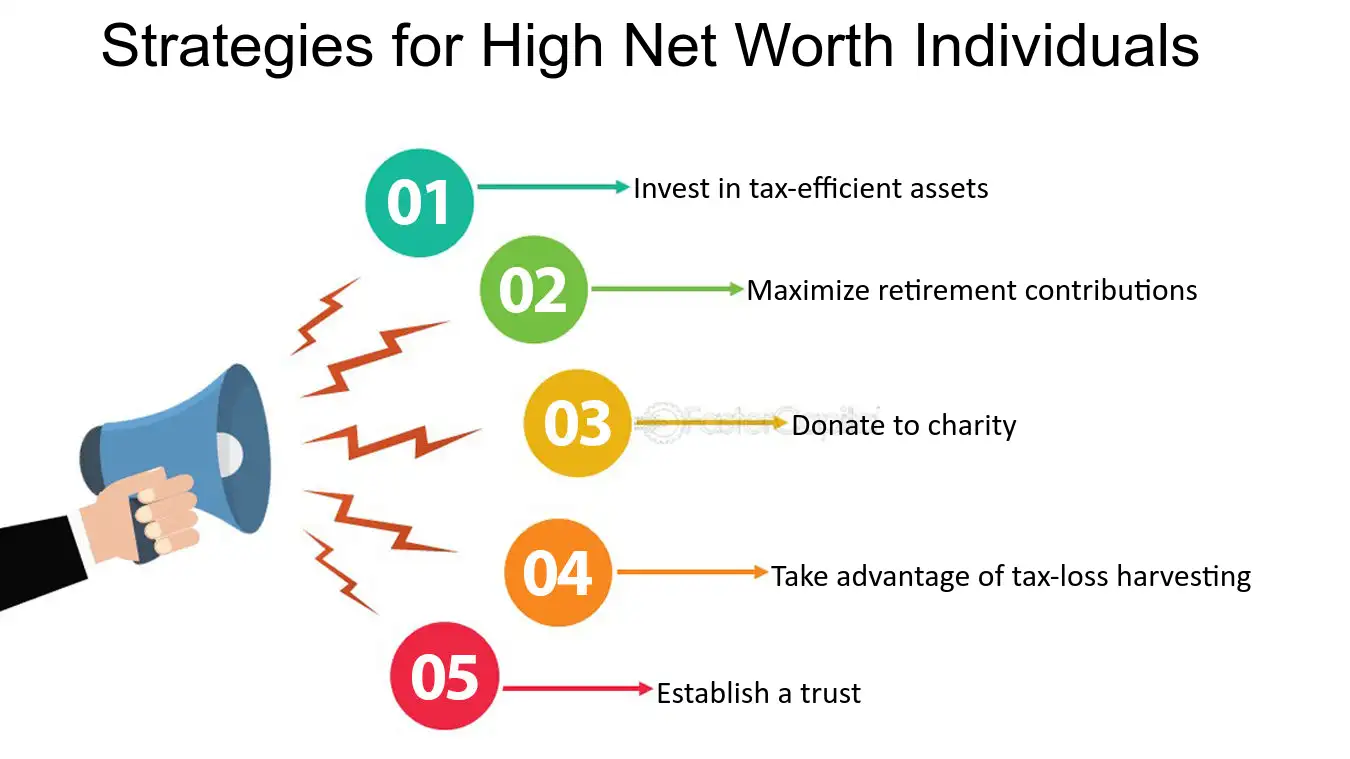

Proactive planning doesn’t stop with vehicles - it extends to all aspects of financial management. For individuals, tax optimization might involve leveraging incentives like the 30% ruling, investing in tax-efficient assets, or strategically planning wealth transfers to minimize future liabilities. For businesses, the focus could include automating tax processes, diligently evaluating expenses, and maximizing deductions to reduce taxable income.

Understanding the tax implications of every financial decision, from choosing the right car to managing business operations and personal investments, is essential. By taking a comprehensive and strategic approach, individuals and businesses can optimize their tax outcomes, avoid unnecessary costs, and make smarter financial choices.

Conclusion

Tax systems may be complex, but with the right knowledge and strategic planning, individuals and businesses can navigate them effectively. Whether you’re considering relocation to a low-tax jurisdiction, setting up a foundation for wealth management, or optimizing your car purchases, informed decisions are essential. Investing in expert advice and staying informed about local and international regulations can help you achieve compliance and long-term financial stability.

After all, a little planning today can save you a lot of headaches tomorrow!